Unlike in the past, the perception of installment savings is steadily increasing, and it is changing to pursue freedom without being bound by deposits and withdrawals rather than making large amounts of money.Because it requires simple conditions, it is easy to open and deposit and withdraw, but I think it is more important to make a more strategic choice and consider safety than to put it in any bank.Compare interest rates on parking accounts and find out what to pay attention to when opening them.

Top 5 Interest Rates and Recommendations for Parking Accounts

Parking will remind you of parking first, and parking account refers to a bankbook that uses a large amount of money held between investments and investments for short storage, such as stopping a vehicle for a while.Even if it is not necessarily for investment purposes, it is also a necessary means of saving for those who prefer and want a high-interest bankbook.However, please note that banks in the primary financial sector as we know usually do not sell high-interest bankbooks, so if you only consider high-interest rates, you should know that they are not safe.

OK Savings Bank (OK Second Bank Account)

In principle, you can sign up for OK Second Bankbook with one account per person, and you can use OK Mobile Banking and SB Talk Talk Plus’s non-face-to-face channels in addition to branches.The method of receiving preferential interest rates will be applied to open banking provided by commercial banks (excluding savings banks)/securities firm apps (APP) by 0.3%p per year (before tax) from the day after registration of OK Second Bank.

Basic interest rate for parking accounts: 3.0% per annum for less than 10 million won (before tax), 0.7% per annum for more than 10 million won (before tax)

Parking account preferential interest rate: 3.3% per annum for less than 10 million won (before tax), 1.0% per annum for more than 10 million won (before tax)

Pepper Savings Bank (Pepper Parking Bank)

In principle, the Peppers parking account is an account per person, and I think it is a very advantageous parking account with a limit of 50 million won and no preferential application conditions.You can sign up through the Pepper Savings Bank app, and the interest payment period is the third Saturday of the last month of each quarter (March, June, September, and December), and the calculated interest is added to the principal the next day. If you calculate as simple as possible, it is a parking account that I personally recommend because it is a good product with 1.6 million won a year minus 250,000 won in interest income tax.

Parking bankbook application rate: 3.2% per year (pre-tax, isolation), 1.0% per year (pre-tax, isolation) less than 50 million won (pre-tax, isolation)

Welcome Savings Bank (Workplace Love Ordinary Deposit)

In principle, WELCOME office workers’ love and ordinary deposits are subject to one account per person and can only be subscribed through branches or mobile banking.Up to 3.0% per year maximum of 50 million won and 2.8% per year if it exceeds 50 million won, but advantageous conditions will apply if only 50 million won is used to protect depositors.However, you have to meet all the preferential conditions for the basic interest rate so that you can receive the maximum interest rate, so you have to consider carefully as there are many annoying parts compared to other products.

Basic interest rate for parking accounts: 1.5% per annum (variable interest rate)

Parking account preferential interest rate condition 1: If you have a salary transfer record of more than 1 million won.

Parking Bank Account Preferential Interest Rate Condition 2: If there is a record of at least one CMS or automatic payment by connecting this month’s deposits.

Parking Bank Account Preferential Interest Rate Condition 3: In the case of consent to the collection and use of personal information (marketing use purpose, etc.) and membership subscription for the month.

KDB Savings Bank (KDB HI non-face-to-face bankbook)

In principle, KDB Hi’s non-face-to-face deposit and withdrawal account is one account per person, and you can sign up through a non-face-to-face real-name verification service.The interest rate is lower than other parking accounts, but the advantage is that there is no limit on the amount of money, so it is very advantageous if you intend to use a large amount.However, depositor protection is possible up to 50 million won, so you should consider carefully and choose.

Parking Account Interest Rate: 2.25% per annum (pre-tax)

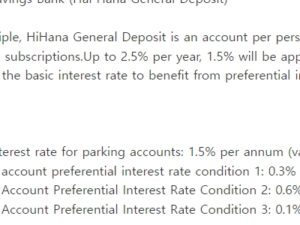

Hana Savings Bank (Hai Hana General Deposit)

In principle, HiHana General Deposit is an account per person, and you can sign up through a branch, mobile APP, mobile WEB (Hana One Q connection), and new Internet banking subscriptions.Up to 2.5% per year, 1.5% will be applied if the maximum is less than 30 million won and more than 30 million won, and preferential conditions must be met for the basic interest rate to benefit from preferential interest rates.

Basic interest rate for parking accounts: 1.5% per annum (variable interest rate)

Parking account preferential interest rate condition 1: 0.3% per year for consent to collect and use personal information and for all product service guidance means.

Parking Account Preferential Interest Rate Condition 2: 0.6% of the balance of 2 million won or more at the end of the previous month

Parking Account Preferential Interest Rate Condition 3: 0.1% when using an account without a paper bankbook

Points to note when selecting a parking account

It’s good to think about safety before investing in parking accounts, but we know that commercial banks can trust more than savings banks and receive reasonable compensation when they have big problems.However, commercial banks (1 financial sector) do not sell deposit and withdrawal products that apply high interest rates, so you have to think carefully about which of the factors of interest rate and safety.

In addition to safety, the shorter the interest payment period, the better the product, and depending on the product, it is better to decide whether the interest rate is different or preferential, not to sign up for a good interest rate.Also, sometimes there are products that are not restricted as much as possible, but when you save a large amount of money, you should take a good look at depositor protection.If depositor protection is up to 50 million won, you must be careful about this because the legally guaranteed amount is 50 million won and the rest of the amount exceeding it cannot be protected.