If you have a late payment record, it will lower your credit score and make it very difficult for you to get additional loans in the future.

Therefore, it’s important to pay back as little as possible, whether it’s a short-term or long-term late payment, but if you have a late payment due to unavoidable circumstances, let’s take a closer look at when it can be removed, how to check short-term and long-term late payments, and what you can do to improve your credit score after a late payment.

Table of Contents 닥터규의 정보도서관

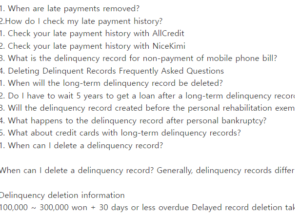

1. When are late payments removed?

2.How do I check my late payment history?

1. Check your late payment history with AllCredit

2. Check your late payment history with NiceKimi

3. What is the delinquency record for non-payment of mobile phone bill?

4. Deleting Delinquent Records Frequently Asked Questions

1. When will the long-term delinquency record be deleted?

2. Do I have to wait 5 years to get a loan after a long-term delinquency record?

3. Will the delinquency record created before the personal rehabilitation exemption disappear after the personal rehabilitation?

4. What happens to the delinquency record after personal bankruptcy?

5. What about credit cards with long-term delinquency records?

1. When can I delete a delinquency record?

When can I delete a delinquency record? Generally, delinquency records differ depending on the amount and number of days overdue.

Delinquency deletion information

100,000 ~ 300,000 won + 30 days or less overdue Delayed record deletion takes 1 year

Over $300,000 + 30 days overdue takes 3 years to delete the overdue record

300,000 won or more + 90 days or more of delinquency 5 years to delete the delinquency record

Late payments of $100,000 or less do not affect your credit score, so you don’t have to worry about small amounts of $100,000 or less.

However, from 100,000 won and above, the time period for delinquency deletion increases significantly depending on the period.

If it is more than 100,000 won but less than 300,000 won and the delinquency period is 30 days or less, it will take 1 year to delete the delinquency record.

If the amount is more than $300,000 and the delinquency period is more than 30 days, it takes 3 years to delete the delinquency record.

If the amount is more than $300,000 and the overdue period is more than 90 days, it takes 5 years to delete the overdue record.

How to delete short-term and long-term delinquencies

In general, short-term delinquencies of 30 days or less can still be deleted in about a year, but long-term delinquencies of 30 days or more take at least 3 to 5 years, so if you have such a delinquency record, not only will your credit rating be lowered, but there will be restrictions on credit card use and other troublesome restrictions, such as difficulty in obtaining additional loans.

Therefore, it’s important to avoid having a late payment record as much as possible.

Also, it is very important to be careful not to create a late payment record, and even if you do not create a late payment record, it is important to resolve the late payment within 5 days because the late payment is shared with the financial sector even if it is more than 5 business days.

Delinquency record deletion information

1 million won or more + 3 months or more Delinquency record deletion takes 5 years

500 million won or more + 1 year or more (for taxes) takes 5 years to delete delinquent records

Alternatively, if you owe more than 1 million won and have not paid for more than 3 months, it will take 5 years to remove the delinquency record. If you owe more than 5 million won and have been overdue for more than a year, you will also need to wait 5 years to delete the delinquency record.

Therefore, it’s important to pay off your delinquencies as soon as possible, unless your situation is really unavoidable.

So, how can you check your short-term or long-term delinquency history? Let’s take a look below.

2.How do I check my late payment history?

You can check your late payment history through the AllCredit and NiceKeyMe sites.

These sites allow you to check your credit report up to three times a year without paying, so you can easily check your credit report using this service.

1. Check your late payment history with AllCredit

Remove a late payment

When you go to the AllCredit site, there is a button on the bottom right that says “Free Credit Report”. If you click it, you can check your credit for free three times a year.

You can use it as many times as you want within 24 hours, once every four months. It doesn’t matter if you are a member or a non-member.

Check your delinquency history

2. Check your late payment history with NiceJikimi

On the Nicejikimi site, you can access the site and go to the

Nurturing Credit Life – Check Credit Score to see your credit score and delinquency history.

Delinquent cell phone payments

3. What is the delinquency record for non-payment of mobile phone bill?

There are many people who have a late payment record due to loans or credit cards, but many people are also worried about having a late payment record due to non-payment of cell phone bills that they usually forget to pay.

You won’t get a late payment record for bills under $100,000, but if the bill piles up, you’ll be in trouble.

First of all, if your cell phone bill is unpaid, depending on the carrier, you will usually receive payment instructions after 2 months, and if payment is not processed even after that, your call will be suspended.

If the payment is not processed even after the call is suspended, the reception is also suspended, and the account is immediately terminated and collected.

Removing short-term delinquencies

It is also important to note that if you have been paying your cell phone bill in addition to the cell phone device installment, regardless of whether it is less than 100,000 won or not, a record of delinquency will be left.

Therefore, if you are not using a cell phone by purchasing an airline or a second-hand product, but you are also paying a cell phone bill, you must be careful not to pay the cell phone bill.